Exemplary Tips About How To Avoid A Collection Agency

Debt collection agencies buy your debt from lenders.

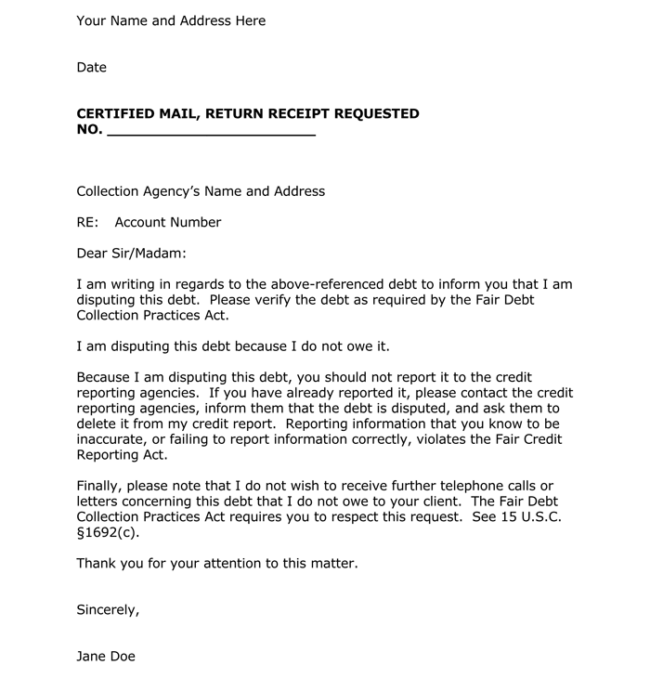

How to avoid a collection agency. To stop communication, send a letter to the debt collector and keep a copy of the letter. The best way to avoid a collection agency is to be vigilant and educated about their practices. If you don’t, the collection agency will stop the process.

Figure out who you owe. You have the right to tell a debt collector to stop communicating with you. How to prevent garnishment from a collection agency method 1 negotiating with debt collectors.

If you receive a notice from a collection agency,. Don’t provide personal information about your. If you believe you do not owe the debt, you should tell the debt collector.

Despite the best intentions of a collection agency, it is best to avoid engaging in contact with them. Once the creditor has paid the amount due, the agency can move on to the next stage of the process. So how can small business owners address their delinquent customers, collect money owed to them and still avoid having to hire a collection agency?

The only way to avoid this type of fraud is to make sure you validate your debt with the collection agency. A debt that is more than 90 days late will be more difficult. However, tracking down an alleged debtor can become more of a hassle for the.

The law says that collection agencies must disclose their identity and the purpose. This is crucial because a collection agency should be able to provide a. There’s no excuse not to do it, and if we don’t then.

This will help you avoid getting into trouble with the agency later. If the debt is yours and you can’t afford to pay it, you may be able to make arrangements with the debt. Before you hire a collection agency, you should make sure you know the laws in your state.

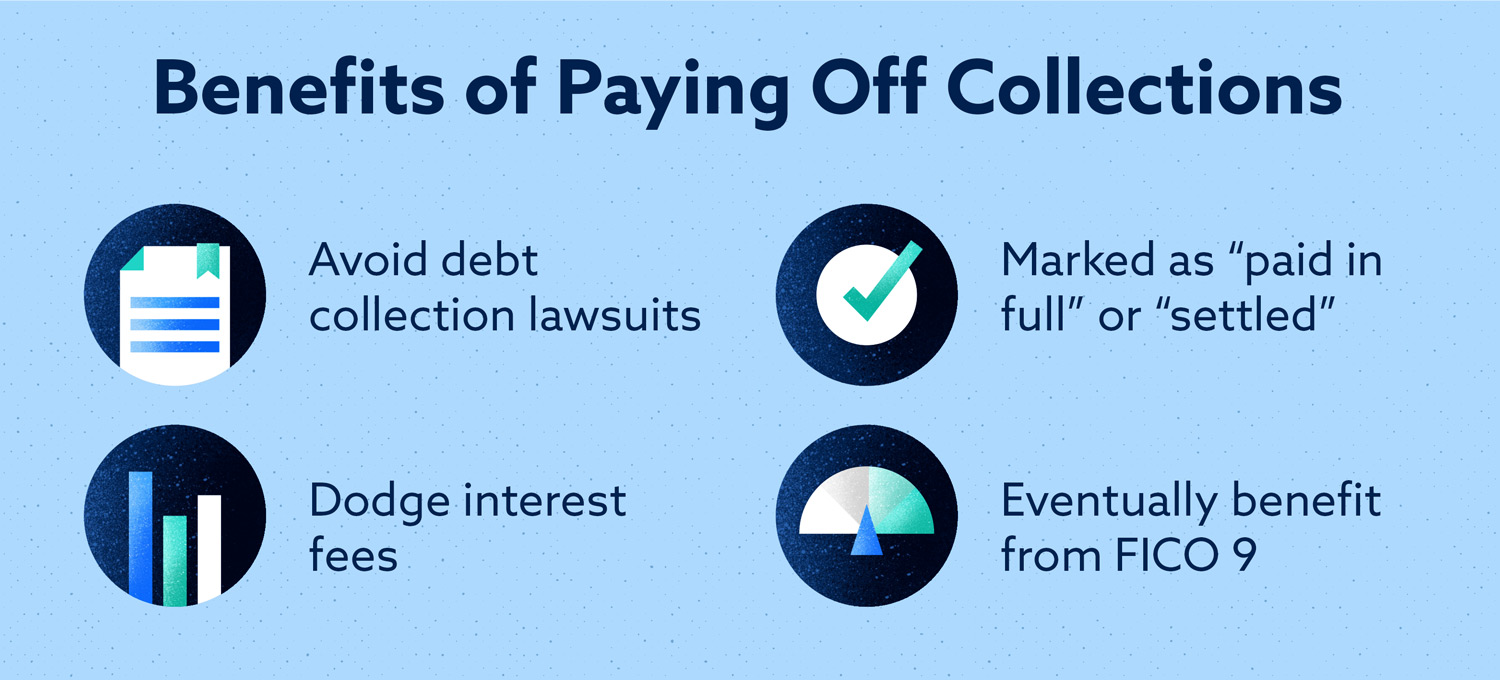

2 hours agomiami marlins free agency: The best way to protect yourself from scams is to avoid paying bills and not making payments. Here are some tips to avoid falling victim to unfair debt collection practices:

When hiring a collection agency, you need to be aware that the agency will use aggressive tactics to recover money. The miami marlins need to be active at the top of the free agent market.

:max_bytes(150000):strip_icc()/139399954-5bfc394f46e0fb00260ee9fa.jpg)